Use the information here at your own risk.

SouthwareAnswers does not provide tax advice. Please contact your CPA for specific information about your requirements.

If you are not sure how to apply the information available, please contact your Southware Solutions Partner.

SouthwareAnswers does not provide tax advice. Please contact your CPA for specific information about your requirements.

If you are not sure how to apply the information available, please contact your Southware Solutions Partner.

NOTE: Southware, starting in 2021, is now providing Federal payroll tax updates for end users on maintenance. Please contact your Partner for more information.

Payroll Changes for 2024 (Updated 1/3/2024)

Please see information below for payroll changes. You should contact your accountant or refer to the IRS website for more updated information.

Social Security and Medicare:

EmployeeThe employee tax rate for social security is 6.2%

(PR-08-02 field 18) The employee tax rate for medicare remains at 1.45% (PR-08-02 field 18) |

EmployerThe employer tax rate for social security remains at 6.2%

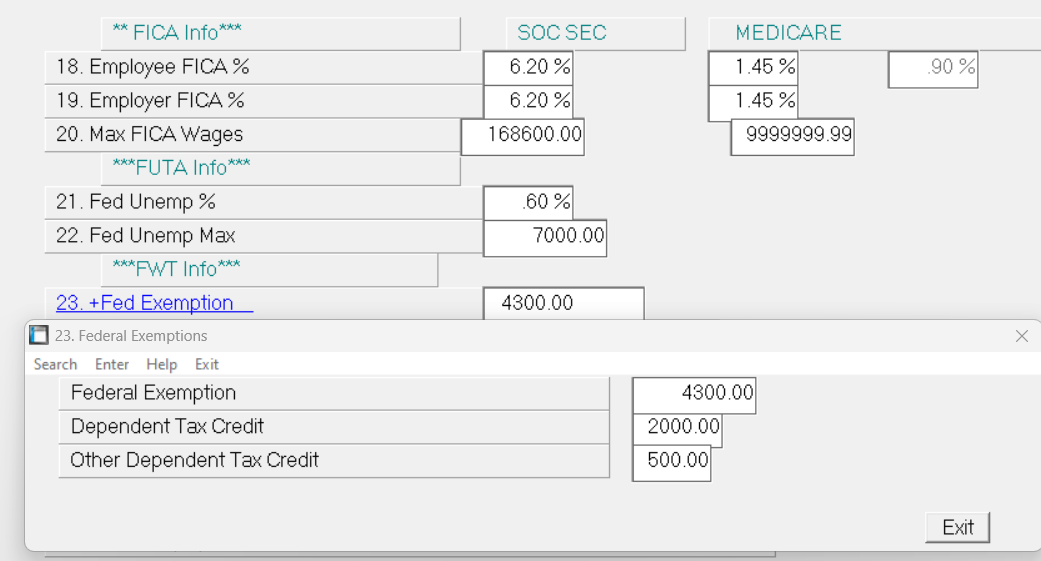

The employer tax rate for medicare remains at 1.45% (PR-08-02 field 19) The wage base limit for Social Security Tax changed to $168,600.00. There is no wage base limit for Medicare Tax. PR-08-02 field 20 SOC SEC $168,600.00 Max FICA Wages Medicare 9999999.99 The Federal withholding allowance is $4,300 PR-08-02 field 23 (Personal Exemption) The Federal withholding tax tables have changed. PR-07-06 (see images below) |

Additional Medicare Tax Withholding

In addition to withholding Medicare tax at 1.45%, you must withhold a 0.9% Additional Medicare Tax from wages you pay to an employee in excess of $200,000.00 in a calendar year. Enter this additional rate in field 18 of PR-08-02.

It is your responsibility to check for changes to state and local tax. If you need help with your state and local withholdings, please call your SouthWare Solution Partner.

Be aware that most clients receive their SUI tax rates in mid-January. If your SUI tax rate has changed, the new rate should be entered in PR-07-07 field 17. If your SUI tax rate has changed and you have processed payrolls for 2023, retroactive adjustments will need to be made for any payrolls processed before the new rate was entered. Some states no longer mail these notices to employers. It is your responsibility to log on your state's website to obtain your tax rate.

Starting in 2012 it was required for Employers to include their health insurance contribution in Box 12 on the Employee's W-2. You may set up recurring employer expense codes to accrue these contributions. See attached procedures for setting up these recurring transactions.

If you have nonresident alien employees and need help with these rates, please call your SouthWare Solution Partner.

As always, check the payroll calculations to make sure the taxes withheld are accurate and correct.

Please call your SouthWare Solution Partner if you need assistance.

It is your responsibility to check for changes to state and local tax. If you need help with your state and local withholdings, please call your SouthWare Solution Partner.

Be aware that most clients receive their SUI tax rates in mid-January. If your SUI tax rate has changed, the new rate should be entered in PR-07-07 field 17. If your SUI tax rate has changed and you have processed payrolls for 2023, retroactive adjustments will need to be made for any payrolls processed before the new rate was entered. Some states no longer mail these notices to employers. It is your responsibility to log on your state's website to obtain your tax rate.

Starting in 2012 it was required for Employers to include their health insurance contribution in Box 12 on the Employee's W-2. You may set up recurring employer expense codes to accrue these contributions. See attached procedures for setting up these recurring transactions.

If you have nonresident alien employees and need help with these rates, please call your SouthWare Solution Partner.

As always, check the payroll calculations to make sure the taxes withheld are accurate and correct.

Please call your SouthWare Solution Partner if you need assistance.

How to Report Employer Insurance Contribution on W-2:

Starting in 2012 it will be required for Employers to include their health insurance contribution in Box 12 on the Employee's W-2. To start accumulating that amount for 2012 set up the following:

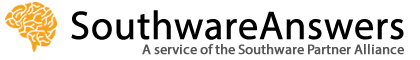

1. Set up an employer expense in PR0708 for the Employer's Health Insurance Contribution:

1. Set up an employer expense in PR0708 for the Employer's Health Insurance Contribution:

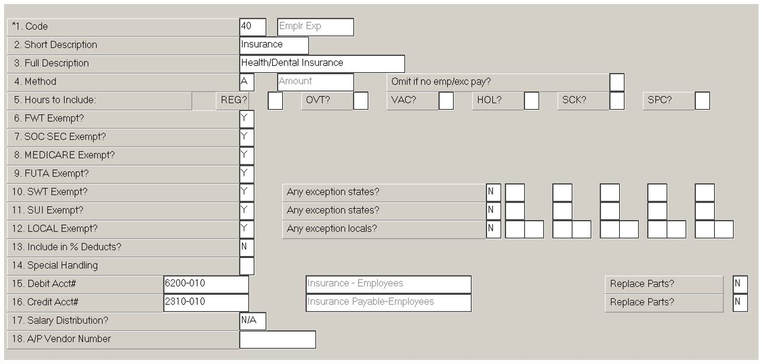

2. Set up a Recurring Code in PR0704 for each employee for the employer expense:

An employer expense is only going to generate GL distributions during the PR check process. It does not reflect the employee's paycheck. It will generate GL for what the employer has to pay for the health insurance and will update the YTD amount in the recurring code. This YTD amount is what will be reported on the W2 at the end of the year.

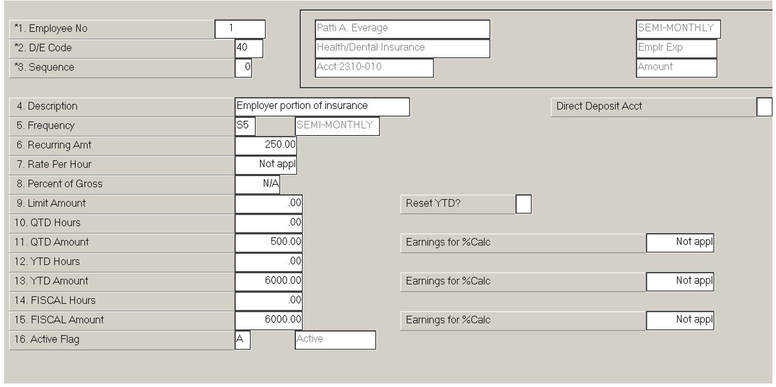

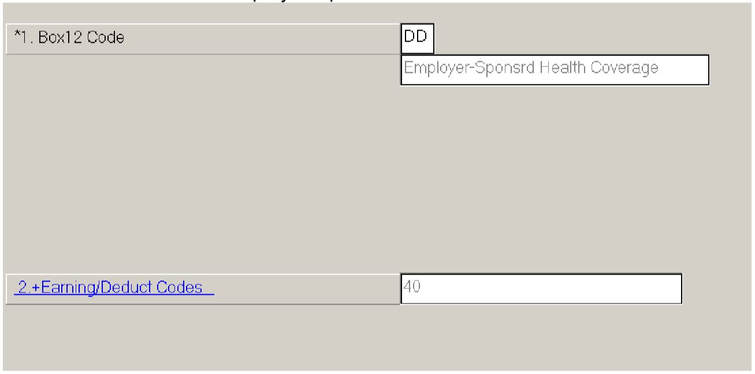

3. When the W2 is built add the employer expense code to the DD type in Box 12. The DD type is the Employer Sponsored Health Coverage. In the W-2 control record go to field 10 which will take you to the Box 12 definitions.

Choose DD code and then in field 2 specify the employer expense code that you used to accumulate the employer's portion of health insurance:

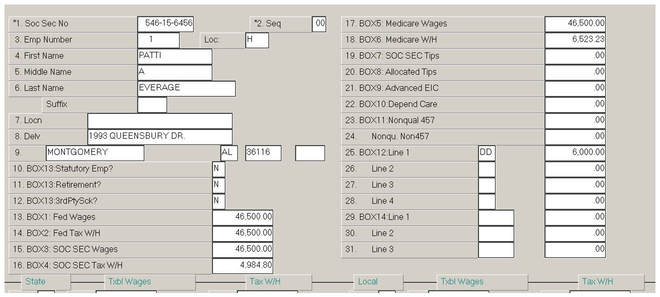

4. When the W-2's are built it will take the YTD amount stored in PR0704 field 13 and will print that amount in Box 12 for DD:

5. PR Control Record (PR0802 field 23): Set up Federal Withholding Allowance and Tax Credits

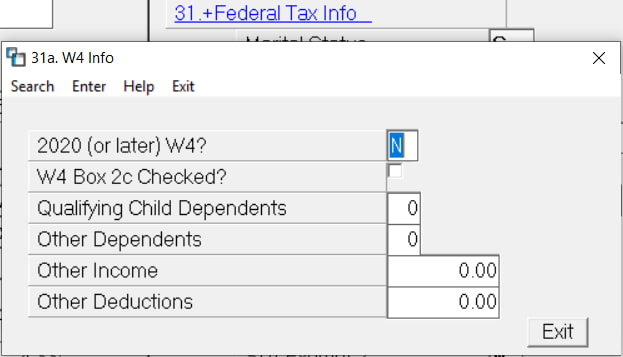

6. PR Employee Record (PR0701 field 31a): There is a new field on the Employee Payroll Record to accommodate the Changes to the W4 for 2020:

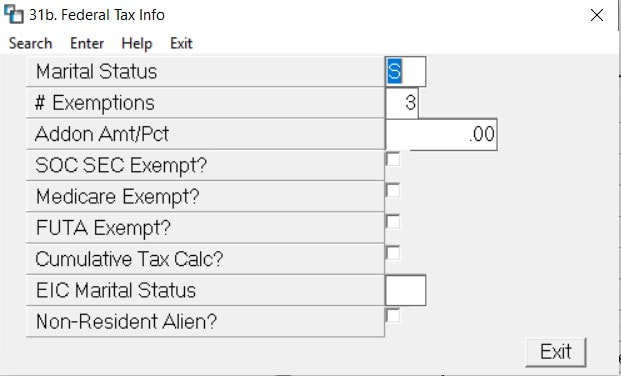

7. Indicate which Federal Tax Table to use based on the Employee W4 Status 31b:

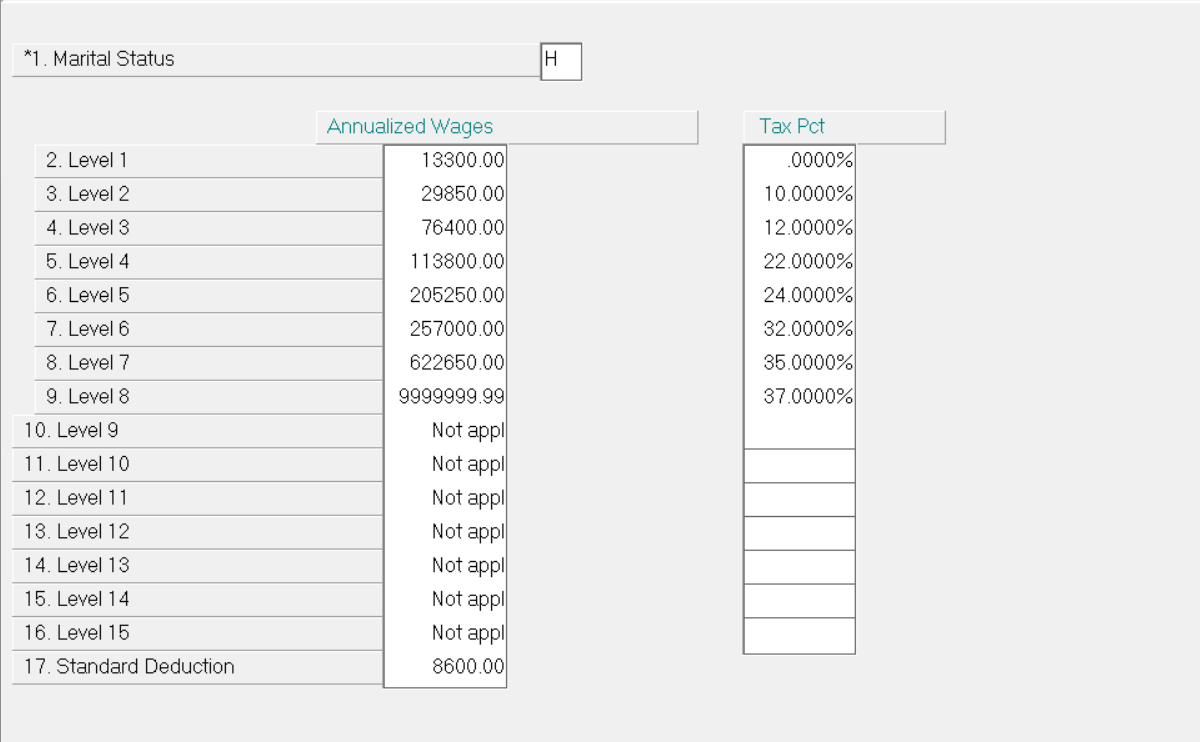

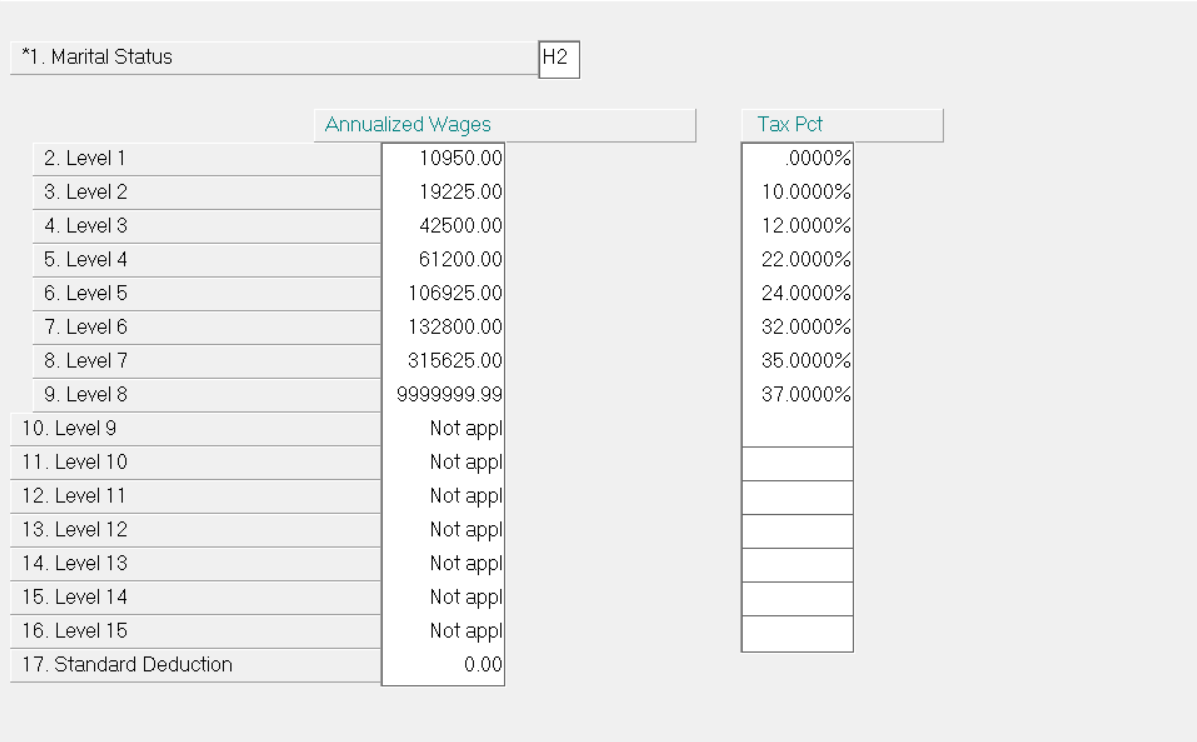

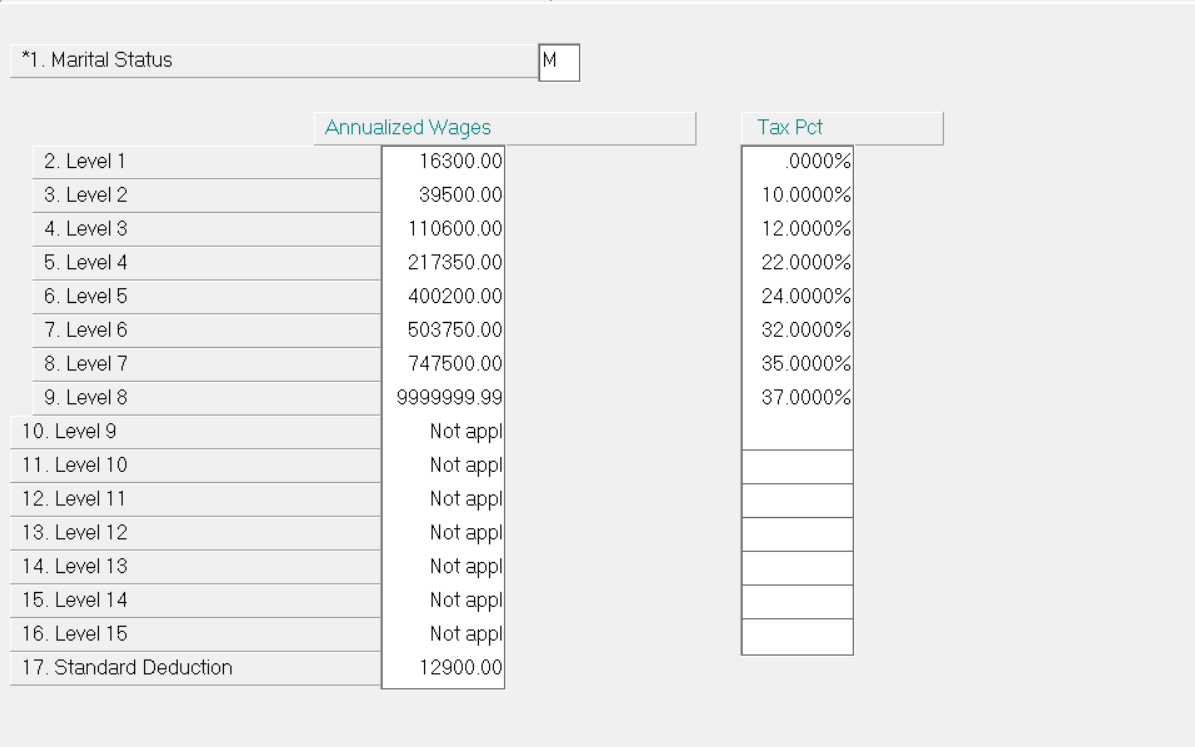

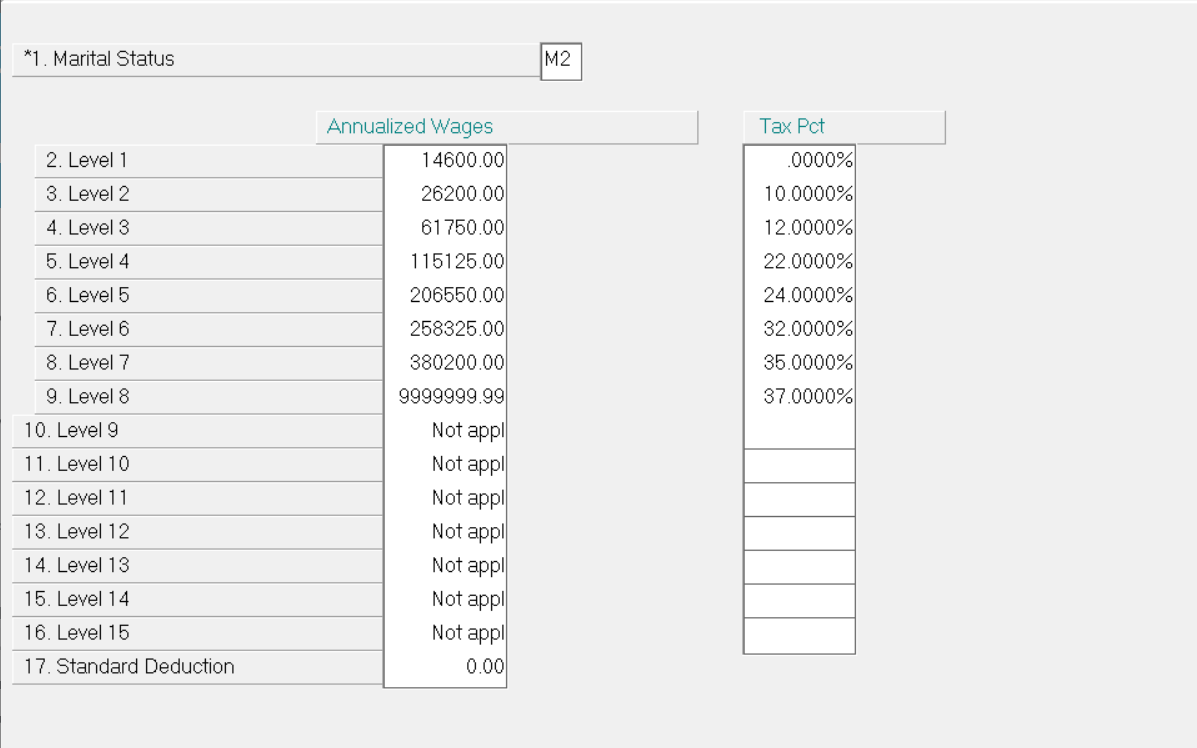

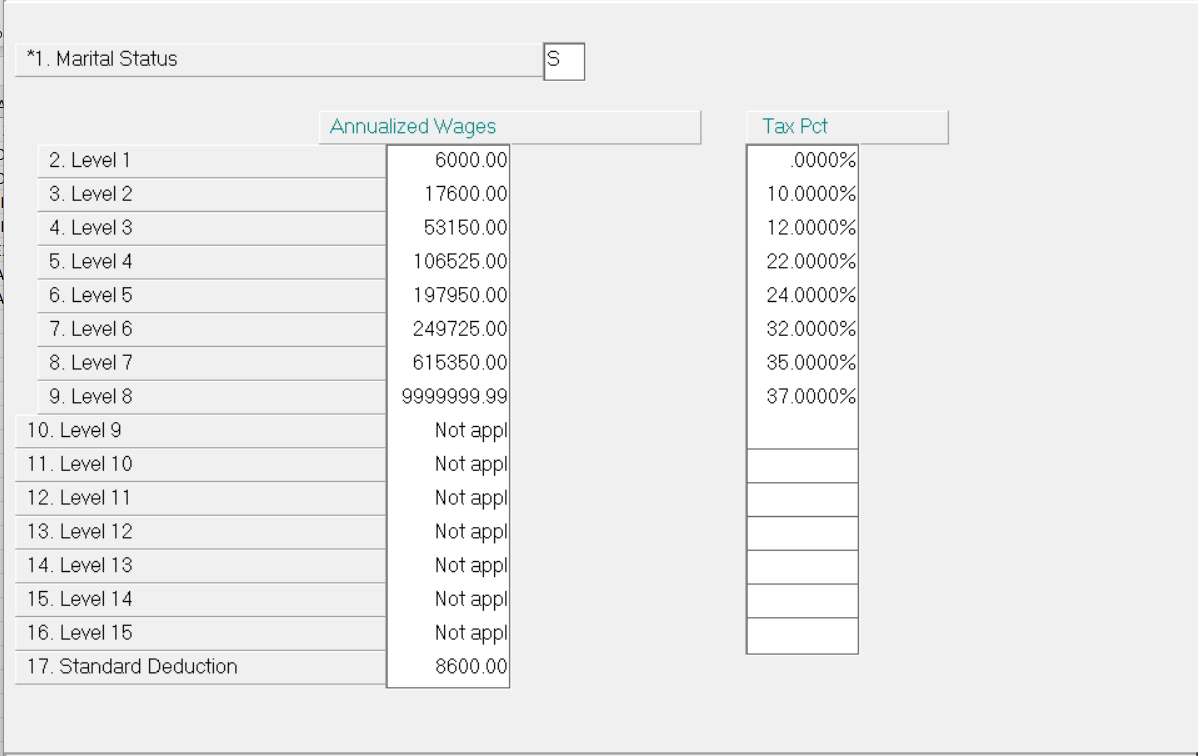

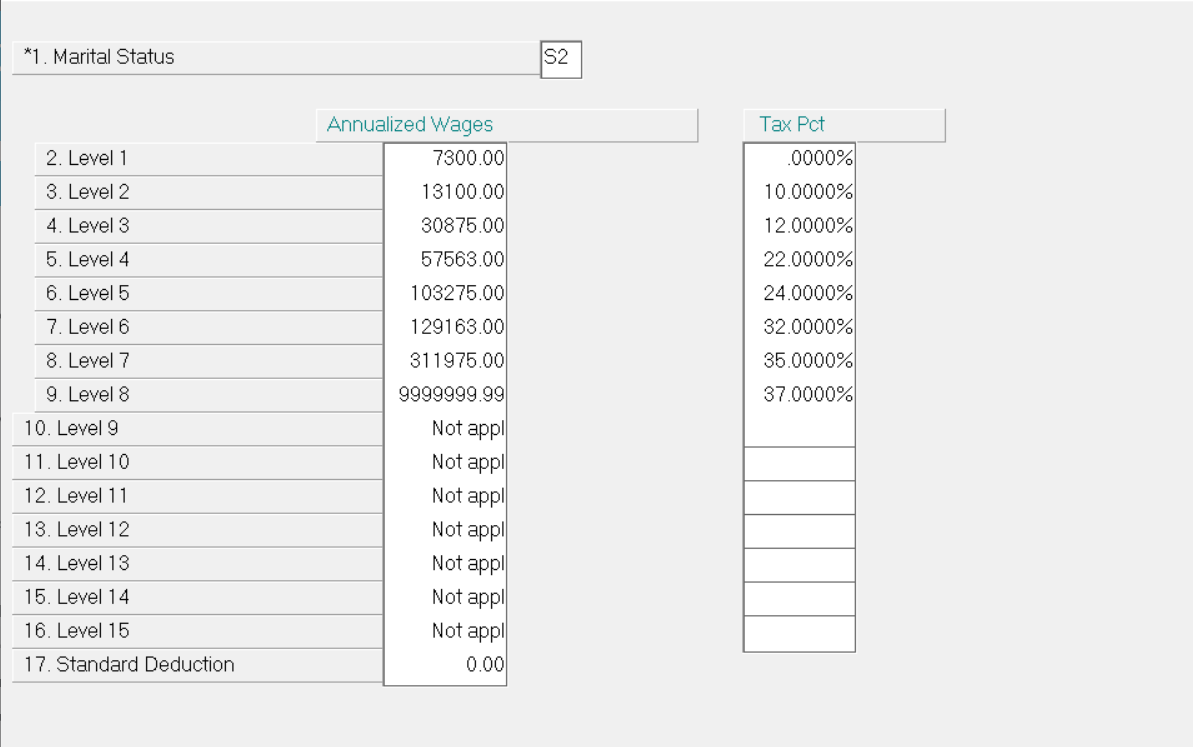

8. Set up Federal Tax Tables in PR-07-06:

|

Use this column of tables if the Form W-4 is from 2019 or earlier, or if the Form W-4 is from 2020 or later and the box in Step 2 of Form W-4 is NOT checked.

|

Use this column of tables if the Form W-4 is from 2020 or later and the box in Step 2 of Form W-4 IS checked.

|

Use the information here at your own risk.

SouthwareAnswers does not provide tax advice. Please contact your CPA for specific information about your requirements.

If you are not sure how to apply the information available, please contact your Southware Solutions Partner.

SouthwareAnswers does not provide tax advice. Please contact your CPA for specific information about your requirements.

If you are not sure how to apply the information available, please contact your Southware Solutions Partner.